Medicare Supplement insurance plans, often referred to as Medigap policies, serve as a valuable resource to mitigate out-of-pocket expenses associated with services covered under Medicare Part A and Part B. These expenses encompass deductibles, coinsurance, copayments, hospital costs beyond Medicare-covered days, skilled nursing facility expenses, and more. Certain Medicare Supplement insurance plans also extend limited coverage for emergency medical services during international travel. With over 10 million Medicare beneficiaries relying on Medigap policies, the popularity of this coverage is evident in its role in safeguarding against unforeseen medical costs.

While Medicare Supplement plans remain an optional choice, a considerable number of Medicare beneficiaries encounter substantial out-of-pocket costs, particularly due to the 20% outpatient expense share they bear. As a result, a substantial portion of individuals invest in Medigap to ensure peace of mind and financial relief from the burden of medical expenses.

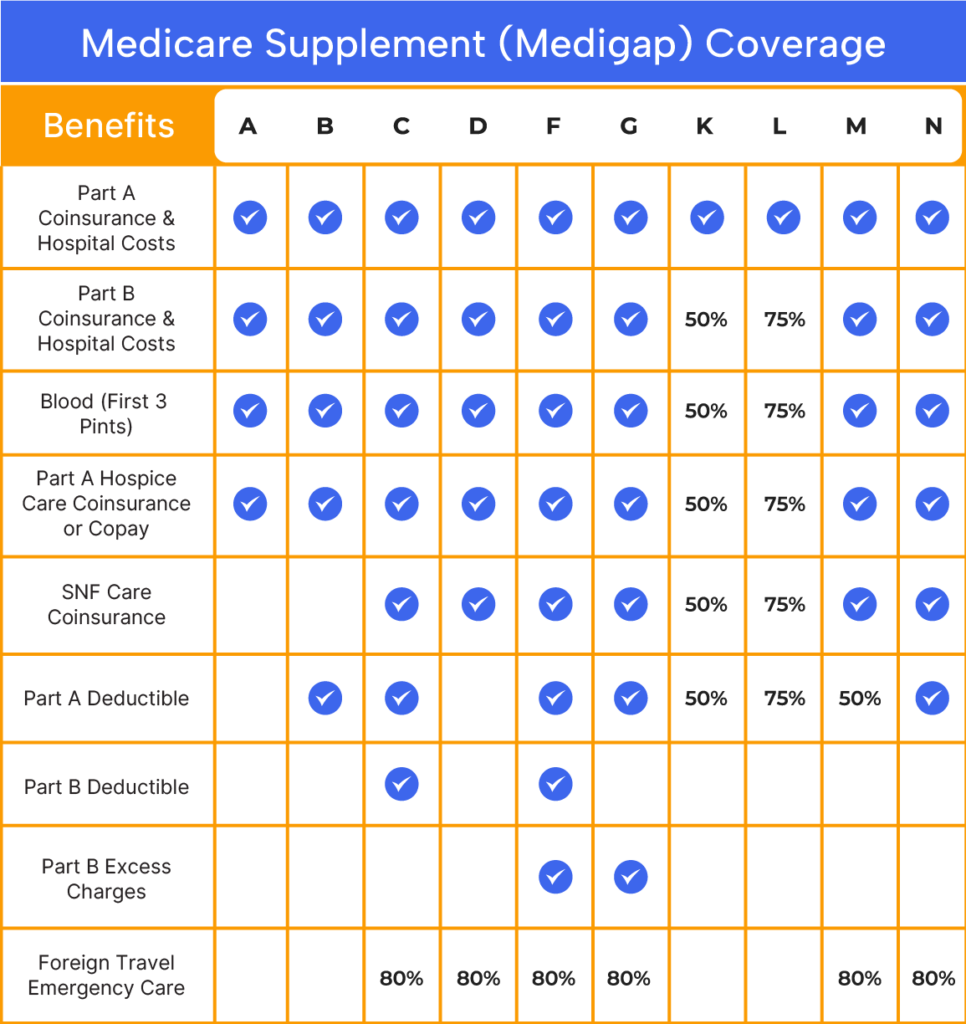

Medigap policies garner significant interest among Medicare beneficiaries due to their inclusive benefits, covering healthcare expenses not accounted for by Original Medicare. These benefits encompass:

Additional advantages encompass:

Certain individuals eligible for Medicare may defer enrollment due to employer-based group health coverage. Upon retirement, these individuals possess the right to secure specific Medigap policies within 63 days of group coverage cessation. This period, known as Medicare Supplement guaranteed issue rights, operates analogously to Original Medicare’s open enrollment. However, it spans a narrower timeframe of 63 days and is restricted to plans A, B, C, F, K, and L. Notably, insurance companies cannot decline applications during this guaranteed issue window.

Other instances warrant guaranteed issue, with variations contingent on state regulations. To ascertain your available options, consult a licensed Medicare agent at Bobby Brock Insurance.

In the event of missing the open enrollment or guaranteed issue period, there’s no need for concern. Eligibility to apply for a Medicare supplement plan persists; however, health-related inquiries will be part of the application process. Contact us today to learn how The Coleman Agency can help.